Some Boeing planes grounded after midair window blowout

The emergency landing of a Boeing 737 Max with a gaping hole in its side is renewing safety concerns about the planes.

The emergency landing of a Boeing 737 Max with a gaping hole in its side is renewing safety concerns about the planes.

Retail data is likely to reveal shopper enthusiasm for Black Friday discounts ahead of fresh stats on Australian consumer prices, housing and jobs.

Australians bought a record number of new cars in 2023 as the COVID comeback continued but cost-of-living pressures have auto makers preparing for a slowdown.

Australians are expected to spend big in the Boxing Day sales, the "Grand Final" of shopping around the nation which starts on Tuesday.

Australians have been urged to look at Christmas as a time for hope in the midst of natural disasters, international conflicts and economic challenges.

Maersk vessels will soon resume sailing through the Red Sea, the shipping company says, following the establishment of an international naval operation there.

Australians have splurged at unprecedented sales on Boxing Day spurred on by a cost-of-living crisis this year.

Perth retains its title as Australia's cheapest petrol capital with regular unleaded costing an average of 183.9 cents per litre for 2023.

disaster (general)

economy, business and finance

environmental issue

housing and urban planning

politics

science and technology

disaster (general)

economy, business and finance

environmental issue

housing and urban planning

politics

science and technology

As storms, floods and bushfires wreak havoc on Australia, a little-known company owned by the nation's governments is in demand for its digital intelligence.

A raft of major policy changes are scheduled to start as the sun sets on 2023, including cost of living relief measures in some states.

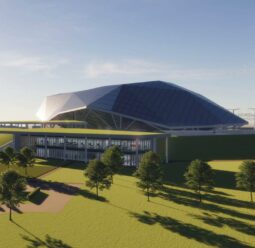

Fancy crackers, chocolates and lollies shared during the holidays are increasingly being made from local ingredients in high-tech manufacturing hubs onshore.

New Year's festivities over, another year of uncertainty has dawned with hangovers from 2023 but some predictions for 2024 suggest better times ahead.

construction and property

economy, business and finance

housing and urban planning

politics (general)

construction and property

economy, business and finance

housing and urban planning

politics (general)

A surprisingly strong year for the Australian housing market has ended on a weaker note, with performance varied across different regions and cities.

The Iranian warship Alborz has entered the Red Sea at a time of raised tensions on the shipping route, Iranian media reports say.

construction and property

economy, business and finance

housing and urban planning

politics (general)

construction and property

economy, business and finance

housing and urban planning

politics (general)

The Australian housing market ended 2023 on a flat note, despite respectable gains across the year, and are likely to fall going into 2024, experts say.

The cost of 32 major road and rail projects across Queensland has almost doubled, with new Transport Minister Bart Mellish promising transparency on the issue.

Australia's population growth has been boosted by higher migration post-pandemic, but these levels will stabilise in coming years.

New fuel quality standards will be introduced to limit the amount of noxious emissions from vehicles, bringing Australia into line with other western countries.

Australians on low and middle incomes could be in for further relief as the Albanese government considers how it can help households under strain.

A push to add nuclear to Australia's energy mix may be silenced by a steep upward revision of the cost of small reactors by the national science agency.

Yemen's Houthi leader says his militia does not fear the United States and has warned outsiders not to target the rebels over attacks in the Red Sea.

A surprisingly positive reading for a key leading index points to green shoots for the economy, though one-off factors may be responsible for the upbeat result.

A $3.7 billion operating surplus for 2023/24 has been projected by the WA government, up from May's $3.3 billion amid the highest economic growth in nine years.

The United States says "Operation Prosperity Guardian" will defend against attacks by Yemeni Houthi rebels on commercial vessels in the Red Sea.

Turkish Airlines has been granted an expansion of services into Australia in a federal government decision following its rejection of a similar Qatari bid.

The central bank board mulled over another cash rate increase or staying on hold at the December meeting, and kept its options open for more tightening.

Bonza's skies are turning purple again, as two new aircraft take off from the Gold Coast, ready to paint 14 Aussie destinations with affordable travel.

The US and a host of other nations are creating a force to protect ships in the Red Sea that have come under attack from Houthi-controlled areas of Yemen.

The mid-year fiscal update contained no extra cost of living relief, although the federal treasurer has not ruled out more help in his next budget.

NSW Treasurer Daniel Mookhey has delivered a budget update his opponents have branded the "nightmare before Christmas".

coal

economy, business and finance

electricity production and distribution

energy

energy and resource

environmental issue

natural gas

politics

coal

economy, business and finance

electricity production and distribution

energy

energy and resource

environmental issue

natural gas

politics

Energy market tsars are out of step with the "rooftop revolution" and other household energy that could be harnessed in a clean, low-cost system, critics say.