Gen X, older millennials ride housing boom to the bank

Poppy Johnston |

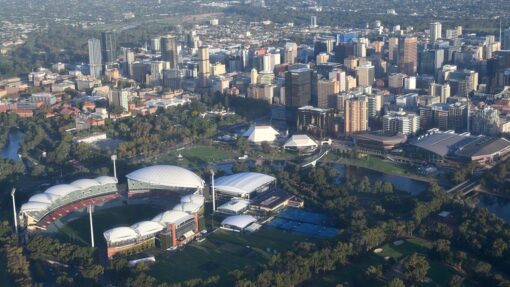

Australia’s real estate boom has resulted in home owners pocketing hundreds of thousands of dollars in profits when selling with the median profit across the capital cities now approaching $400,000.

The likelihood and size of profits at the point of sale has inflated as property values have tracked higher, with generation X and older millennials managing to capitalise the most from rising housing prices.

For houses, sellers made a median profit of $395,000 across the combined capitals, according to a report from property marketplace Domain.

This was more than twice the median profits on units sold across the major cities, of around $163,000, reflecting stronger price growth for houses and owners holding onto apartments for shorter periods of time.

The proportion of profit-making sales also reached their highest level in more than a decade, with 96 per cent of houses and 90.7 per cent of units reselling for a profit last financial year.

This was unsurprising given consistent growth in home values, Domain chief of research and economics Nicola Powell said.

Despite tough economic conditions and higher interest rates, Australia’s residential property market had posted six consecutive quarters of price gains, taking nation-wide values to record highs.

Dr Powell said generation X and older millennials had benefited the most from favourable market conditions.

“Interestingly, this group, typically in their late 30s to late 40s, has leveraged their established positions in the property ladder to capitalise on the recent price boom,” Dr Powell said.

Losses in residential property remain rare, making up just four per cent of house sales in Australia and 9.3 per cent of units.

Dr Powell said this was typically when a home was purchased just before a market correction.

“This situation may lead some sellers to accept a loss based on their individual circumstances, particularly under the current ‘higher for longer’ cash rate,” she said.

Persistent inflation has the Reserve Bank of Australia warning interest rates may need to go higher though the more likely scenario is rates staying on hold for longer, perhaps until 2025.

Of Australia’s major banks, Commonwealth Bank of Australia is the only one predicting a late-2024 start to cuts, while ANZ and Westpac are forecasting a February 2025 start and May for National Australia Bank.

AAP