Doctors group welcomes GP tax verdict

Rachael Ward |

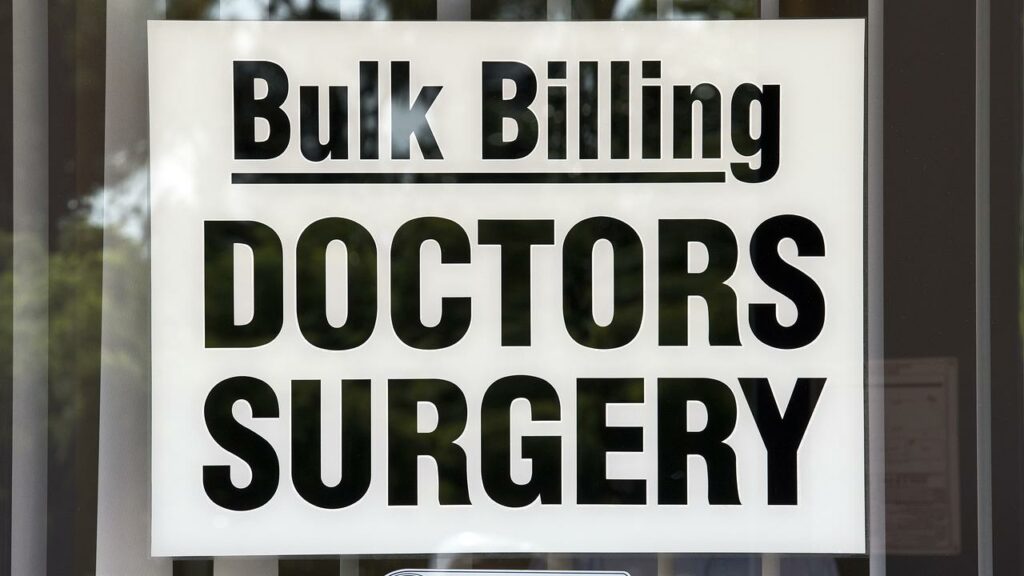

A dispute between general practitioners and the Queensland Revenue Office has been resolved, after fears it would force clinics to close and end bulk billing.

Some clinics were hit with backdated payroll tax bills worth up to several million dollars in 2022.

The Australian Medical Association claimed the unexpected bills were prompted by a legal decision in NSW, which led to a new interpretation of Queensland’s tax laws.

Previously, clinics paid payroll tax for receptionists, nurses and other employees but doctors were treated like contractors because clinics did not pay their wages, superannuation or other entitlements.

The AMA threatened bulk billing would have to end due to the unforeseen cost, after some clinics received retrospective bills for the past five years.

The Queensland Revenue Office will now limit audits to the 2021/2022 financial year and beyond.

AMA Queensland president Maria Boulton said the decision allowed clinics to budget for bigger payroll tax bills going forward.

“Many GP practices faced closure in the face of these unexpected bills, leaving communities without doctors,” Dr Boulton said.

“We hope this means those backdated tax bills will be cancelled and those practices can go back to delivering care to patients.”

Dr Boulton also called for other states to limit similar audits on GP clinics, saying about four in every five practices in Queensland would have been affected.

“We are facing a GP crisis across the nation. Now is not the time to add extra financial pressures on GPs,” Dr Boulton added.

In November, Queensland Treasurer Cameron Dick said tax arrangements hadn’t changed but compliance checks had instead ramped up, although GPs were not being targeted.

The Queensland Revenue Office also denied the NSW decision changed the scope, practice or approach of its tax collection.

AAP