Tech giant founder targeted as federal police raid firm

Ben McKay |

Software giant WiseTech’s value has plummeted after its headquarters were visited by Australian Federal Police investigating alleged improper trading by four employees.

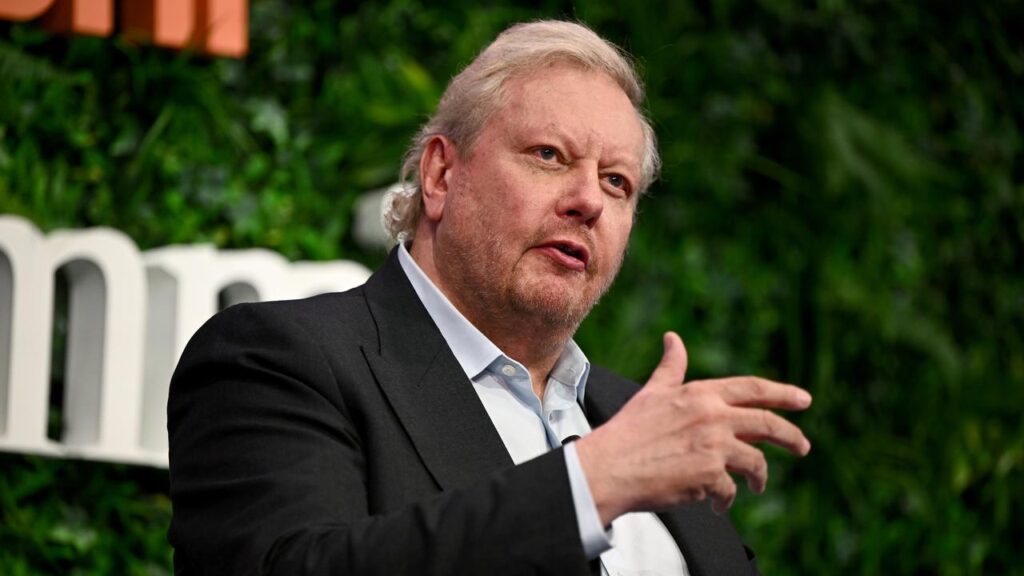

Billionaire executive chairman Richard White and three others were the subject of a joint probe by the AFP and the Australian Securities and Investments Commission on Monday.

The company revealed the raid in a statement to the ASX on Tuesday morning.

“They executed a search warrant requiring the production of documents regarding alleged trading in WiseTech shares by Richard White and three WiseTech employees during the period from late 2024 to early 2025,” the statement read.

“So far as WiseTech is aware, no charges have been laid against any person and there are no allegations against the company itself.

“WiseTech intends to fully co-operate with any investigation.”

An ASIC spokesman confirmed its call.

“Yesterday morning (October 27), ASIC, with assistance from the Australian Federal Police, executed search warrants as part of an ongoing investigation,” a statement read.

“As the investigation is ongoing, ASIC is unable to provide further comment at this time.”

The AFP is yet to comment on the probe.

Earlier in 2025, the Australian Financial Review reported the Sydneysider sold more than $200 million worth of WiseTech shares without following proper process.

Those allegations include trading during formal black-out periods when senior executives are barred from selling stock.

WiseTech, founded by Mr White in the 1990s, provides software to power logistics companies and is one of Australia’s biggest technology companies.

How long that lasts is not clear, given news of the AFP-ASIC visit collapsed its share price.

WiseTech shares began Tuesday at $85.02 but sunk by 15 per cent in the opening 30 minutes of trading.

The investigation is the latest saga to engulf Mr White’s recent leadership of the company.

They included bullying allegations – which were subsequently cleared by a company-ordered review – aired last year and revelations of the 70-year-old’s personal affairs.

Those grievances saw Mr White leave the role of chief executive late in 2024 – while retaining his $1 million salary – only to return as executive chairman in February.

Four directors left the board just days before that announcement, which coincided with another share value plunge.

In March, Australian Super sold off a $580 million stake in the company after nine years of ownership, citing governance concerns.

AAP