Calls to bring forward PM’s plans for student loan help

Jack Gramenz, William Ton and Rachael Ward |

Three million Australians’ annual student debt repayments will be lowered if government plans before the next election are successful, as the prime minister is urged not to wait after unveiling the first major pitch to voters following a string of controversies.

The minimum repayment threshold for student loans would jump by about $13,000 a year, so graduates would begin paying down debts once they earned $67,000, instead of $54,000, from July 1, 2025.

The government would also move to a marginal repayment system in which the amount of a debt repaid was a proportion of income above a given threshold, as recommended by the Universities Accord.

The announcement comes as Prime Minister Anthony Albanese seeks to turn a new page following controversy over his Qantas flight upgrades and a home purchase.

Revelations Mr Albanese received 22 free flight upgrades from Qantas, some during his time as transport minister, and denied allegations he liaised personally with the airline’s former boss Alan Joyce have dogged the prime minister for much of the week.

Before that, controversy brewed around his decision to buy a $4.3 million clifftop property on NSW’s central coast, with questions over whether the purchase was a “good look” during a cost-of-living crisis.

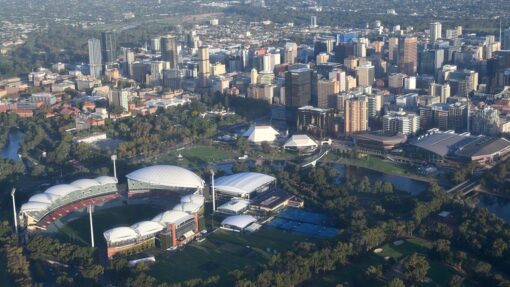

Mr Albanese will join South Australian Premier Peter Malinauskas for a rally on Sunday to detail the student loan policy as he starts to lay out Labor’s agenda ahead of the next election, expected by May.

“This is what Labor governments do – we help people under pressure and we build for the future,” Mr Albanese said.

“This will be the heart of the positive and ambitious agenda we take to the Australian people at the next election.”

An average HELP debt holder will save about $680 per year, with graduates earning $70,000 set to pay $1300 less and those on $80,000 getting a cut of $850.

The changes would affect about one million young Australians and would apply to all graduates earning up to $180,000 a year.

The government will aim to legislate the changes in 2025 to take effect in the next financial year.

Greens Senator Mehreen Faruqi welcomed the plan but criticised its ambition and timeline.

“Labor wants people to wait (until) July next year when people need help now,” she said.

Indexation should be scrapped altogether, as proposed in a Greens bill Labor has blocked, Senator Faruqi said.

“Bring this legislation to parliament next week so we can pass it this year,” she said.

Universities Australia hailed the move as a win for students, with the cost of living factored into a person’s decision to start and finish university.

“This additional relief will provide much-needed support for those already paying off a HELP debt,” the organisation said in a statement.

“We also hope it will give more people confidence to study at university.

“Australia needs a strong pipeline of skilled workers to ensure our future success, which means educating more graduates.”

AAP