Inflation surges as energy rebates run out of gas

Jacob Shteyman |

Surging inflation has dashed hopes of one last rate cut and heightened expectations energy rebates will be extended.

Expiring electricity subsidies helped drive up the annual consumer price index from 3.6 per cent to a 16-month high of 3.8 per cent in October, the Australian Bureau of Statistics reported on Wednesday.

The Reserve Bank’s preferred trimmed mean measure, which smooths out volatile items, edged up 10 basis points to 3.3 per cent.

Not only are both figures above the central bank’s two to three per cent target range, but they are also above forecasts for the end of the year.

ANZ senior economist Adelaide Timbrell said acceleration in the trimmed mean would keep the Reserve Bank on high alert about the re-emergence of inflation risks.

“Today’s print supports our view that the RBA will hold in December and increases the risk that the easing cycle has ended,” she said.

Wednesday’s release was the first publication of the ABS’s long-awaited “full” monthly CPI, which will provide the Reserve Bank with a more timely and accurate gauge of price pressures in the economy.

Ms Timbrell said the Reserve Bank board was likely to take the result with a pinch of salt at its next interest rate meeting, given it would still prioritise the quarterly inflation release until seasonal gremlins were ironed out.

“Still, the extent of the upward surprise is likely to have an impact on the RBA board’s thinking around the future path of monetary policy,” she said.

Monthly, the CPI was unchanged from September to October. But a fall in inflation in October 2024 dropping out of the data series resulted in the jump in the annual figure to 3.8 per cent.

The consensus of forecasters was for a rise of only 3.6 per cent.

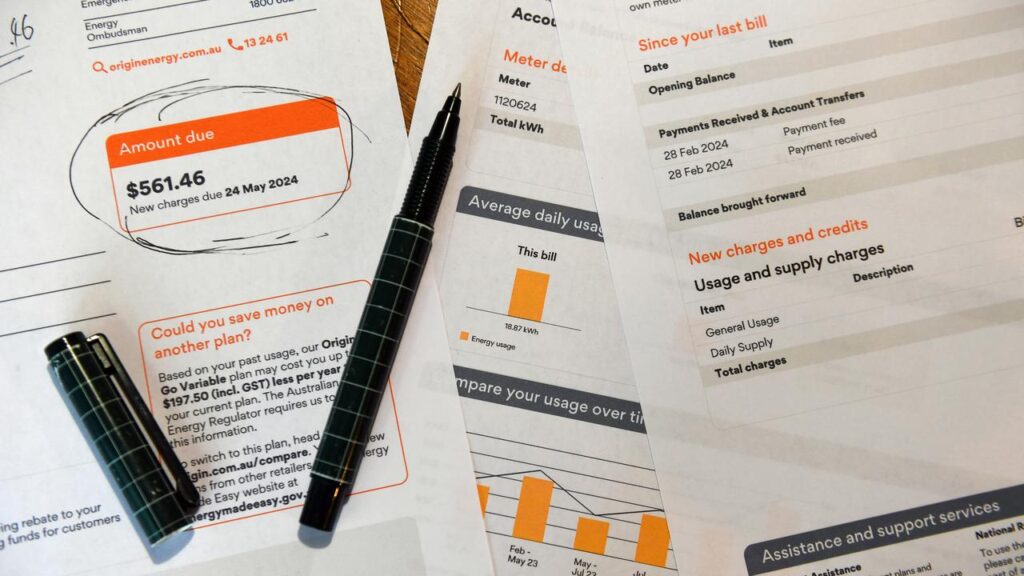

Electricity was the biggest contributor, up 37.1 per cent in the 12 months to October, as households used up state government energy rebates.

“The timing of the rollout of the Commonwealth Energy Bill Relief Fund rebates also impacted electricity costs,” the ABS said.

Veteran economist Chris Richardson said the data was “problematic” for the Reserve Bank and the government, with federal energy rebates set to lapse at the end of the calendar year.

“Current trends also increasingly suggest that the government will soon announce an extension of electricity price subsidies,” he wrote on X.

“Today’s new data say retail electricity prices are 21.4 per cent below market prices as a result of electricity rebates.

“That’d be truly terrible policy. But it looks increasingly canny politics. And if you’ve wondered which will win a Canberra tug-of-war – good policy or good politics – then you haven’t been paying attention for a couple of decades now.”

Treasurer Jim Chalmers said the rise in inflation was driven by temporary factors such as the removal of state energy rebates.

“When it comes to those electricity rebates, they are a really important way that we are helping Australians with the cost of living, taking some of the edge off these electricity price pressures that people encounter,” he told reporters in Canberra.

“They’re a really important part of our budget, but they’re not a permanent feature of our budget.”

Importantly, market services and housing costs continued to grow faster than the Reserve Bank would be comfortable with.

After leaving the cash rate on hold at 3.6 per cent on Melbourne Cup day, Reserve Bank governor Michele Bullock said the bank thought a spike in inflation in the September quarter was largely down to temporary factors.

But she noted there could be some “signal” amid the noise in the form of rising housing and market services prices, which could indicate inflation was more entrenched.

Rents were up 4.2 per cent across the year and new dwelling price growth climbed from 1.5 per cent to 1.7 per cent.

AAP