Hands out for handouts: bailouts loom for more smelters

Andrew Stafford, Zac de Silva and Abe Maddison |

Taxpayers could be tapped to bail out more smelters and refineries after a mining giant received a $600 million lifeline for two ailing facilities.

A day after Glencore’s funding injection, the Tasmanian government has called for another funding package to back an aluminium smelter in the island state’s north.

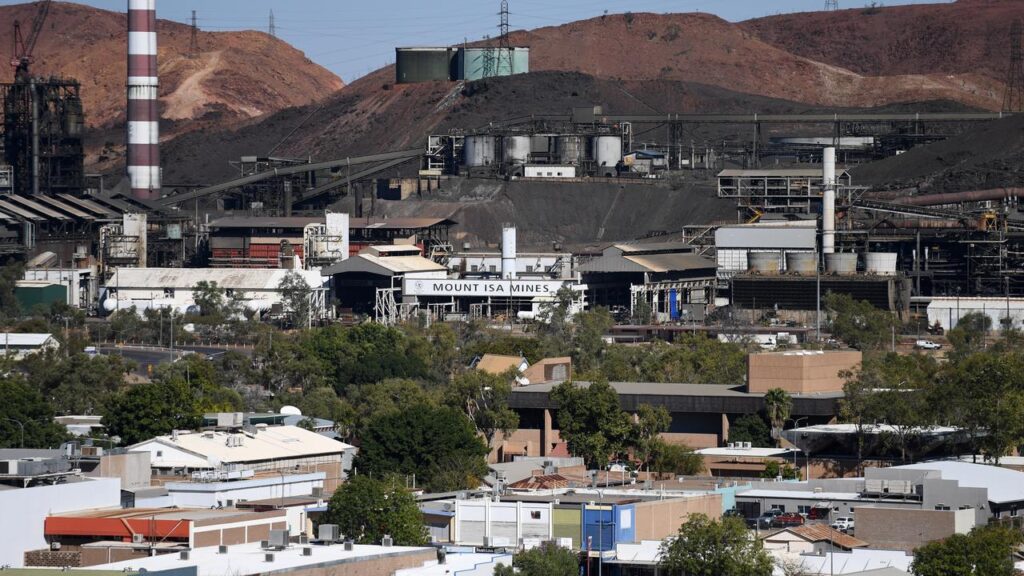

Industry Minister Tim Ayres on Thursday did not rule out further rescue deals after state and federal governments pitched in for a three-year deal to keep the Mount Isa copper smelter and Townsville copper refinery running, protecting 600 jobs.

Bell Bay Aluminium should be next in line to receive help, Tasmania’s Energy Minister Nick Duigan said.

The Rio Tinto-owned aluminium smelter is renegotiating the price it pays for power with Hydro Tasmania but needs a federal subsidy to stay afloat, he said.

The smelter’s 10-year deal with Hydro Tasmania has a December 31 deadline, sparking fears it will close at the end off the year with talks stalling.

“The gap between what Hydro Tasmania is currently offering and what Bell Bay Aluminium needs is not something the Tasmanian taxpayer can fund alone,” Mr Duigan said.

Bell Bay Aluminium employed about 600 people, supported hundreds more and accounted for more than 10 per cent of the state’s total goods exports, he said.

Soaring power prices and international competition are set to spark more bailout demands, with Australia’s largest energy user – the battling Tomago Aluminium smelter in NSW – already in the queue.

Representatives for Tomago, which is also majority-owned by Rio Tinto, are in talks with the federal and NSW governments over a bailout reportedly worth more than $1 billion with thousands of jobs up in the air.

Senator Ayres said the government was “watching the situation in these smelters and heavy industry closely” when asked if he was expecting further bailout packages after the Glencore deal.

In February, the Albanese government announced a $2.4 billion bailout for South Australia’s Whyalla steelworks, while a $135 million package for Nyrstar’s smelters in Tasmania and South Australia was unveiled in August.

The lifeline was thrown to Glencore to bolster facilities that were part of a crucial strategic sector for Australia, Senator Ayres said.

Volatile markets and subsidies from foreign governments had made the international copper trade an “unfair” playing field for Australian producers, he added.

The $600 million Glencore lifeline might not be enough to save its Mount Isa facility with the future of a key supplier up in the air.

The copper smelter relies on a nearby Dyno Nobel fertiliser plant for production.

Dyno Nobel might shut down the fertiliser plant if it does not find a new buyer by March, potentially jeopardising Glencore production and the lucrative bailout.

“Dyno Nobel is looking forward to engaging with Glencore over the coming weeks to understand the impact of the deal reached on its manufacturing operations at Phosphate Hill,” Dyno Nobel told AAP.

David Whittle, the co-founder of the Critical Minerals Consortium, said Australia needed to preserve critical mineral industries but “ultimately, we also need to get paid for it”.

China’s successful 40-year project to exert control over supply chains for its vast manufacturing capability had major implications.

“There needs to be some wheeling and dealing on the part of the federal government with our partners to ensure that they’re helping with this – we’re the providers,” Dr Whittle said.

“This opportunity is only going to be realised if we can get some preferential deals of some kind with our trade and security partners, so that they are providing enough funds to these mines … to make it worthwhile to actually produce these minerals in Australia.”

Prime Minister Anthony Albanese indicated he would discuss the preferential supply of critical minerals when he meets US President Donald Trump.

AAP