Rising cost to build a wake-up call on housing dream

Abe Maddison |

A rise in construction costs is likely to stoke inflation while pushing home-building targets further out of reach, fresh data analysis suggests.

Construction costs rose 0.5 per cent in the June quarter, picking up slightly from a 0.4 per cent rise in the March quarter, according to property analyst Cotality’s latest Cordell Construction Cost Index.

The re-acceleration is likely to weigh on inflation outcomes because the cost of new dwellings comprises the largest weight in the consumer price index, Cotality research director Tim Lawless said.

While noting the increase was half the pre-pandemic decade average of one per cent, Mr Lawless said builders struggle with feasibility assessments amid high material and labour costs.

“With the cost of building a new home continuing to rise, the (government’s) stretch target of building 1.2 million new homes by July 2029 is looking harder and harder,” he said.

Property Council of Australia policy and advocacy executive Matthew Kandelaars said the uptick in construction costs “chips away at the feasibility of new housing projects” when the nation needs to be accelerating towards the target of 1.2 million new homes.

Better investment and tax settings are needed, Mr Kandelaars said, along with smarter and more efficient approvals and more skilled workers to build the homes.

“Without this balance, we’ll remain stuck in a doom-loop of low margins, constrained project feasibility, cost blowouts and delivery delays.”

Independent government advice body the National Housing Supply and Affordability Council warned the federal government in a May report that it would fall short of its 2029 goal by about 300,000 dwellings.

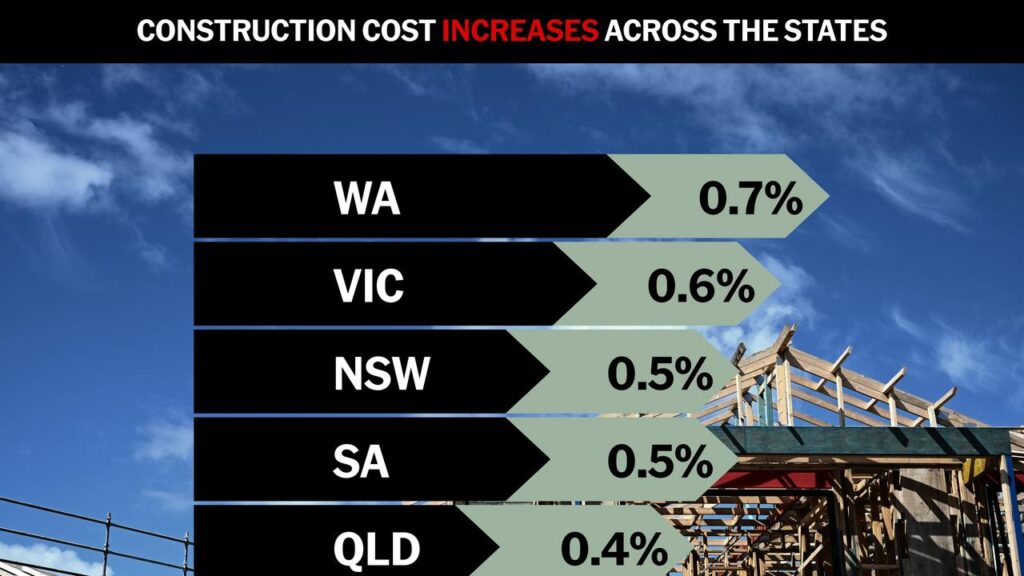

Western Australia recorded the largest quarterly increase in construction costs in the three months to June at 0.7 per cent, followed by Victoria (0.6 per cent), NSW and South Australia (0.5 per cent) and Queensland (0.4 per cent).

Cotality said the latest data reinforces commentary from the Reserve Bank in its July 8 decision to maintain the cash rate at 3.85 per cent, which highlighted as a concern the re-acceleration of growth in the cost of new dwellings via the monthly CPI indicator.

In her rates commentary, the central bank’s governor Michele Bullock noted certain components of monthly inflation – particularly home-building costs – had been “slightly stronger than expected”, which contributed to the decision to hold rates.

The RBA added that high construction expenses continue to exert upward pressure on inflation, reinforcing its cautious stance.

Competition for skilled trades also remains intense amid a record level of public infrastructure spending, with Infrastructure Australia forecasting a mismatch between the demand and supply of labour until mid-2028.

This means continued inflation pressure is likely from building costs centred on the labour market, Mr Lawless said.

AAP