WiseTech cops first strike on pay as probe continues

Adrian Black |

Shareholders have revolted against an Australian tech giant’s leadership, dealing a first strike on remuneration less than a month since Australian Federal Police raided the company’s offices.

Almost one in every two WiseTech shareholders rejected executive pay deals for billionaire founder Richard White and company executives at the group’s annual meeting on Friday, punctuating more than 12 months of scandals, boardroom chaos and now a probe by the Australian Securities and Investments Commission.

Mr White, under investigation along with three staff over allegations of selling company shares during a blackout period, choked back tears in his annual address to shareholders.

“I want to thank the whole WiseTech team with their passion and brilliance, our customers and partners for their trust and collaboration, and of course, you, our shareholders or your ongoing belief in WiseTech,” he said, stopping briefly as his eyes welled up.

“I’m sorry, I’m very passionate about this company.”

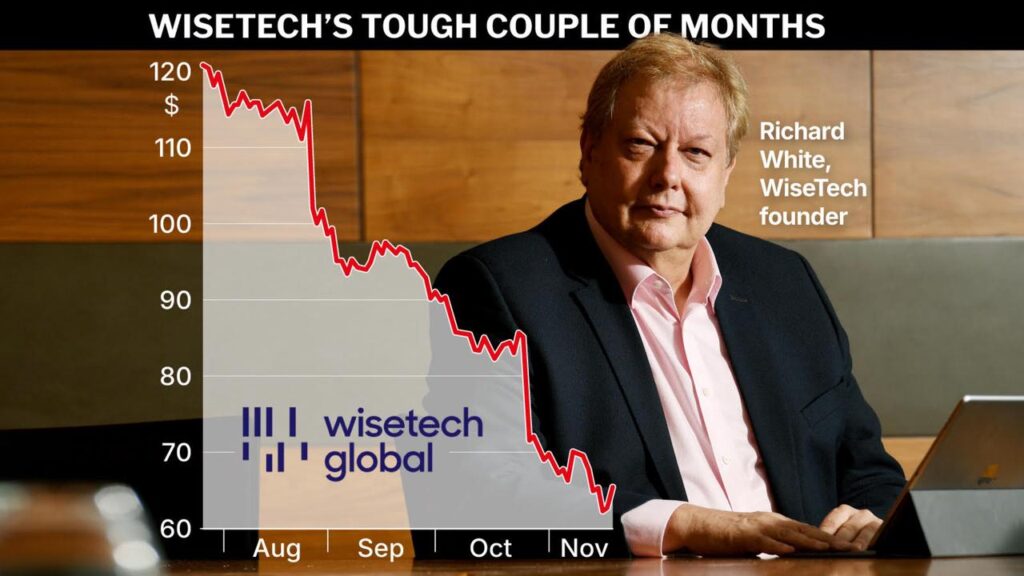

Mr White admitted it had been a challenging time, which had drained more than 50 per cent of WiseTech’s share price in 12 months amid a board exodus and allegations of bullying and undisclosed relationships against the founder.

An independent review later cleared Mr White of the misconduct allegations, which he had denied.

“Throughout this past year, our team has shown great resilience and continued to drive growth while executing on the company’s strategic priorities,” he said.

His speech on Friday came a day after the retirement of director Michael Gregg, who had announced his departure along with Charles Gibbon in June, the latest in a host exiting the company’s board in 2025.

New lead independent director Andrew Harrison took the opportunity to assure shareholders the company was on-track, and played down speculation about the probe by the Australian Federal Police and ASIC.

“Let me be very clear, this matter is only in the investigation stage, and no charges have been brought against any individual, nor have any allegations been made against WiseTech Global,” Mr Harrison said.

“We know that speculation can have real impacts on our people, on confidence and on shareholder sentiment, but what I can assure you is that WiseTech was built over three decades on a solid foundation by a combination of organic and inorganic growth initiatives and a diverse and highly skilled team.”

WiseTech’s board review process, which has included work from independent auditors, would continue under the current board.

Mr Harrison was re-elected as a non-executive director, but noted he did not plan to serve a full three-year term after almost a decade with the company.

“Once the new board is fully in place and working well, I intend to step down with another non-executive director assuming the role of lead independent director,” he said.

WiseTech’s leadership succession plan included the appointment of Zubin Appoo in July, months after Mr White appointed himself executive chair of the company.

In his first annual meeting at the helm, Mr Appoo hailed the group’s financial performance and confirmed forward guidance with expected revenue between $1.39 billion and $1.44 billion and earnings before interest, taxes, depreciation, and amortisation of between $550 million and $585 million.

“Clearly, this has been a challenging period, but it is precisely in these conditions that strong organisations distinguish themselves,” Mr Appoo told shareholders.

“We are focused. We are accelerating. We are fully committed to delivering.”

Investors liked what they heard, with WiseTech whip-sawing from a 2.8 per cent drop at the start of trading on Friday to a 3.6 per cent gain to $66.52 by the afternoon.

AAP