Nervous wait for Queenslanders as health care giants fight over fees

Richard Dinnen - Queensland Editor |

Queenslanders with Bupa private health insurance are wondering if they’ll still be covered for Australia’s biggest private hospital provider, Ramsay Health Care, as a dispute between the two goes down to the wire.

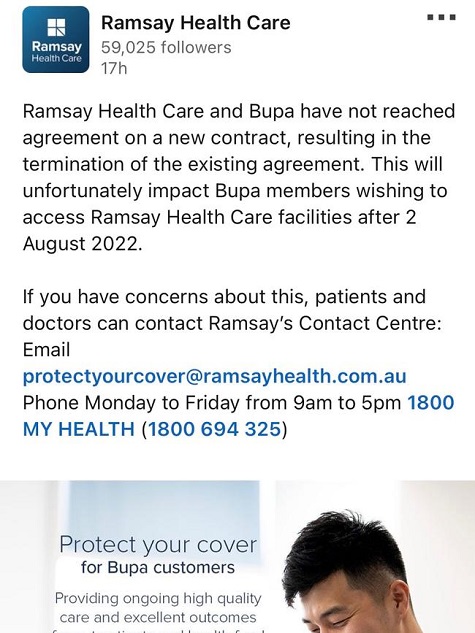

Agreements between insurers and health providers are renegotiated regularly to take account of rising costs. Ramsay says its current agreement with Bupa will end on August 2.

The parties have been unable to reach a new agreement, with Ramsay telling Bupa customers to review their options or face increased gap costs.

In a recent public statement, Ramsay Australia CEO, Carmel Monaghan, said costs have risen significantly.

“What Bupa has offered does not address the cost increases hospitals have experienced in recent years to protect our patients and health care workers.

“Unless benefits paid by Bupa increase to cover Ramsay’s increased costs of delivering care, additional out-of-pocket costs will apply to Bupa-insured patients.

“Another option available to them is to consider switching insurance providers, as Ramsay has agreements with all other private health funds in Australia.”

But Bupa says Ramsay is seeking an unreasonably high rates of increase that would lead to a sizeable premium increase for its customers.

Managing Director, Chris Carroll, said Ramsay was trying to increase the value of its business, which he said is currently the subject of a private equity backed takeover offer.

“We will continue negotiating with Ramsay for a fair and reasonable rate of increase on behalf of our members.

“We want health insurance to remain affordable for Australians. All parts of the health system, including hospital groups such as Ramsay, have a key role to play in keeping costs down.

“We will be communicating with our members and doctors to keep them informed of any updates.”

Mr Carroll said Bupa customers would be covered at Ramsay facilities until the current agreement expires.

“If you’re booked in for an operation you will still be covered during that period.

“After that period, the choice to charge members an out-of-pocket cost will be a decision made by Ramsay as Bupa intends to continue paying its current rates, which are above the statutory default rates.”

Ramsay Health Care is Australia’s largest operator of private hospitals and day surgery units, with 72 across the nation and 18 in Queensland. A consortium led by KKR & Co has launched a A$20.1 billion takeover bid.

Bupa is a global health insurance and healthcare group, headquartered in the United Kingdom, with more than 38 million customers worldwide, four million in Australia.

The two companies have been locked in an at times bitter public exchange in recent months.

The dispute has attracted the attention of the Commonwealth Ombudsman, and the Australian Medical Association president, Omar Khorshid, who urged the parties to continue negotiations.

“Both parties in a negotiation had the right to get the best deal they could, but some larger private health insurers were increasingly trying to use their market power to squeeze private hospital operators in order to improve their own bottom line.

“Unfortunately, BUPA members are now caught in the middle and facing higher out-of-pocket costs, which undermines the value of their policies and broader public confidence in our private health system.

“That’s one of the reasons why the AMA is proposing a Private Health System Authority that can ensure a level playing field and ensure our private health system works to support patients to access high quality and affordable care.”